If your fixed-rate mortgage deal is coming to an end, you may be wondering what to do next, especially as interest rates and property prices are still fluctuating. When your initial mortgage term expires, you will typically be automatically transferred to your lender's standard variable rate (SVR), which can be significantly higher than the rate you were paying before. To avoid this spike in your monthly payments, it may be a wise move to remortgage and secure a new deal.

Remortgaging involves switching your mortgage to a new lender or renegotiating the terms with your existing provider. It's an important financial decision that shouldn't be taken lightly, as it can potentially save you thousands of pounds or cost you dearly if not handled correctly. To help you navigate the process, here are 10 essential things you need to know when remortgaging your home.

1. Start Early

Don't wait until the last minute to start exploring your remortgaging options. Ideally, you should begin the process at least three to six months before your current deal expires. This will give you ample time to research and compare different lenders, products and rates without feeling rushed.

2. Check Your Credit Score

Your credit score plays a crucial role in determining the mortgage rates and terms you'll be offered. Before applying for a remortgage, obtain a copy of your credit report from one of the major credit reference agencies (Experian, Equifax or TransUnion) and ensure that all the information is accurate. If you find any errors, dispute them immediately to improve your chances of securing the best deal.

3. Calculate The Value of Your Home and the House Prices in Your Local Area

The value of your home will affect the loan-to-value (LTV) ratio, which is a key factor in determining your mortgage rate. Lenders typically offer lower rates to borrowers with a lower LTV ratio, as it represents a lower risk. You can get a professional house valuation or use online tools to review property prices and estimate your home's current market value.

4. Consider Your Goals

Are you looking to pay off your mortgage faster, reduce your monthly payments, or release equity from your property? Your remortgaging goals will influence the type of product and term you should choose. For example, if you want to pay off your mortgage sooner, you might opt for a shorter-term deal with higher monthly payments.

5. Compare Deals and Fees

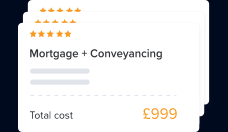

Don't just focus on the headline rate when comparing remortgage deals. Pay close attention to the overall costs, including arrangement fees, house valuation fees and any early repayment charges (ERCs) you might incur for leaving your current lender before the end of the term.

6. Understand the Different Mortgage Types

Remortgage products come in various forms, such as fixed-rate, variable-rate, tracker, and offset mortgages (https://www.onedome.com/mortgages/mortgages-explained/). Familiarise yourself with the pros and cons of each type to choose the one that best suits your circumstances and risk tolerance:

Fixed-Rate Mortgages: Fixed-rate mortgages have an interest rate that remains unchanged for an agreed period, typically ranging from 2 to 10 years. This option provides predictability and stability, allowing you to budget your mortgage payments easily. However, if interest rates fall during your fixed term, you won't benefit from the lower rates until you remortgage again.

Variable-Rate Mortgages: Variable-rate mortgages have interest rates that fluctuate based on market conditions. These mortgages usually start with an initial fixed-rate period, after which the rate becomes variable. While variable-rate mortgages can be more affordable when interest rates are low, they expose you to the risk of rising payments if rates increase.

Tracker Mortgages: Tracker mortgages are a type of variable-rate mortgage where the interest rate is directly linked to a specific economic indicator, such as the Bank of England's base rate. The mortgage rate moves in tandem with the tracked rate, usually at a set percentage above or below it. Tracker mortgages offer transparency, but they also carry the risk of rate fluctuations.

Offset Mortgages: Offset mortgages allow you to link your mortgage to your savings accounts with the same lender. The savings you hold are deducted from the outstanding mortgage balance, reducing the interest you pay. This can be a strategic option for those with substantial savings.

7. Consider Portability

If you're planning to move homes soon, check if your current mortgage is portable. A portable mortgage allows you to transfer your existing deal to a new property, potentially saving you money on fees and avoiding early repayment charges.

8. Get Advice

Remortgaging can be a complex process, and it is always a good idea to seek professional advice from a qualified mortgage advisor. They can help you assess your options, negotiate with lenders and ensure you get the best deal possible.

9. Prepare Your Documentation

Lenders will require various documents to process your remortgage application, such as proof of income, bank statements, identification and information about your current mortgage. Gather these documents in advance to avoid delays.

10. Be Aware of Regional Differences

Mortgage regulations and practices can vary slightly between England, Wales and Scotland. For example, in Scotland, the legal process for transferring property ownership differs from that in England and Wales. In Scotland, the process is known as the Scottish system of land tenure. This system differs from the one used in England and Wales, where properties are typically held under freehold or leasehold tenures. If you're remortgaging a property in Scotland, it is important to understand these specific requirements and consult with a local solicitor who is familiar with the Scottish legal system and property laws. They can guide you through the process, ensuring that all necessary steps are taken and that the remortgage complies with the relevant regulations.

Remortgaging your home can be a complex and time-consuming task, but it is worth making the effort to secure a better deal and potentially save a significant amount of money over the life of your mortgage. By following these 10 tips and seeking professional advice when needed, you can navigate the remortgaging process with confidence and make an informed decision that aligns with your financial goals.

At CMME, we have a remortgage calculator and a handy guide to remortaging your home: https://www.cmmemortgages.com/guides/contractor-remortgage-guide-how-get-one/ CMME is part of the same group as Nethouseprices and OneDome. OneDome acts as a referrer to CMME Mortgages, who are regulated and authorised by the Financial Conduct Authority. If you do not keep up the repayments on your mortgage, your home may be repossessed.

Nethouseprices Newsletter

You can sign up to our newsletter and join Nethouseprice’s community of over 160,000 members who get regular property tips, relevant offers and news, click here http://nethouseprices.com/auth/user-register

Make a comment